They offer learning experiences, references, networking opportunities and something tangible to talk about in an interview. A good internship can possibly lead straight to a position, and even if it doesn't it provides you an undeniable edge-- a Millennial Branding survey shows that 91% of employers think that students must have in between one and 2 internships before finishing.

Doing several internships also supplies a fantastic display screen of work ethic, which is an in-demand quality in the financing market. And Financing internships have the unusual bonus offer of being paid (in lots of cases). And unless you're deadset on one field, try to diversify your internship locations-- much like an excellent portfolio.

These managers are accountable for the general efficiency of the portfolio. They are likewise anticipated to describe financial investment choices and methods in meetings with stakeholders. Fund managers work specifically with hedge funds or shared funds. Both fund and portfolio supervisors often make buy or sell decisions in response to sirius xm billing phone number rapidly altering market conditions.

On the basis of their evaluation, a management group rates the danger of a business or federal government not being able to repay its bonds. Danger analysts examine the threat in investment decisions and figure out how to manage unpredictability and limitation potential losses. This job is performed by making financial investment choices such as selecting dissimilar stocks or having a combination of stocks, bonds, and mutual funds in a portfolio.

The 3-Minute Rule for What Type Of Finance Careers Make Good Money

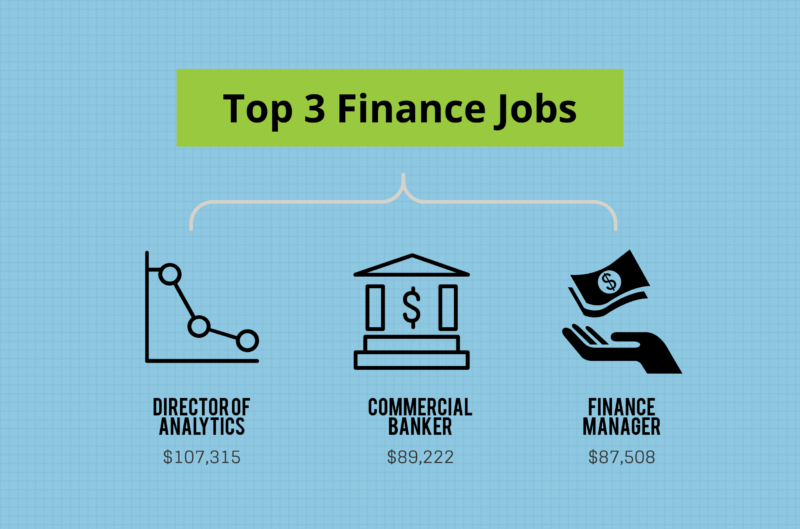

There are likewise plenty of options besides financial investment banking and sales & trading, like corporate banking, business financing, acting in a CFO capability for a startup, working as a financial advisor, or even retail banking. You can get a much better keep reading what your alternatives are with our career map, you can click the Task Titles and find out more particular information for each position (what their responsibilities are, how much they get paid, and so on).

They examine the efficiency of stocks, bonds, and other types of financial investments. You'll require an ability to search for market patterns and financial investment opportunities while using solutions and analytical analysis to compute threat and prospective outcomes. In this role you'll require to have a strong understanding of data and a flair for translating data into practical investment advice.

They produce financial reports, direct investment activities, and develop techniques and prepare for the long-term monetary goals of their company. The particular roles carried out by these professionals will differ, however tasks like preparing monetary declarations, handling employees within the department, evaluating monetary reports and documents, examining market patterns and helping senior management with important organization choices prevail.

They sell securities to individuals, advise companies looking for investors, and conduct trades. You'll buy, sell and trade commodities on behalf of customers-- similar to the yelling men in those 80's motion pictures. If operating in an investment banking role, these experts want to secure capital for customers by discovering purchasers for bonds or stock.

The Definitive Guide for Which Finance Firm Can I Make The Most Money Doing Public Finace

Due to the fact that of this, numerous finance positions require a strong understanding of sophisticated mathematics and computer technology. These are the most important words you're going to hear: never stop hustling. Chase opportunities that excite you, but be all set to put in the time-- all of it. All of the time you have, all of the time.

Then you'll require both grit and an excellent GPA Network, network, and network The finest thing you can do to get a job in Finance is, plain and easy, to know someone who understands someone-- this can be from internships, courses, or an expert company on school. Connect to the individuals you understand from college, trainees or not.

Join a good professional company like a few of those noted at the end of this page and benefit from every resource at their disposal. Haunt all of those CFA events in your location (how to use google finance to simulate how much money you make). And anywhere possible, just speak with individuals, and be friendly-- http://hectorjsbt514.lucialpiazzale.com/9-easy-facts-about-what-is-new-mexico-activities-or-expenditures-do-the-bond-issues-finance-2017-shown likeability might not matter once you get the job, but it sure helps getting one.

Begin on your CFA Level 1 exam (L1) as quickly as possible. It timeshare cancellations takes a recommended 250 hours of research study, so coming out of undergrad with the very first test already pass makes you stand apart You'll need to pass 3 examinations and have four years of qualified work experience to get the classification, but the very first examination can be taken in the last year If you can't land that ultra-prestigious internship, work for a local investment advisor instead of cutting yard-- since you need to consider developing a profession, not getting a dinky paycheck - what finance jobs make the most money.

The Buzz on How To Make Big Money In Finance

Start discovering how to talk cash Do you understand what EBITDA, BPS, MBS, CDS, and the federal discount rate indicate? You require to, to start checking out the Wall Street Journal and brushing up on your lingo. Even if you're memorizing these terms in your college coursework, a capability to discuss this knowledge and see how it's utilized is vital for interview success.

Licenses, Certifications, and Registrations The Financial Industry Regulatory Authority (FINRA) is the primary licensing company for the securities industry. It needs licenses for numerous monetary analyst positions. Most of the licenses require sponsorship by an employer, so business do not anticipate individuals to have these licenses before beginning a task.

For this accreditation, consultants need to have a bachelor's degree, complete a minimum of 3 years of relevant work experience, pass an exam, and consent to stick to a code of principles. The exam covers the monetary preparation procedure, insurance and risk management, staff member benefits planning, taxes and retirement planning, financial investment and realty planning, debt management, planning liability, emergency situation fund reserves, and analytical modeling.

Monetary analysts can become CFA accredited if they have a bachelor's degree, 4 years of qualified work experience, and pass three exams. Financial experts can likewise become licensed in their field of specialized. The CFA designation is well appreciated in the financial market. You can take the first exam throughout your final year of school, however you'll need to pass three examinations and have four years of qualified work experience to get the full-on CFA classification, MBA The crucial thing is to figure out if it will truly benefit you at the firm and in the field you desire-- not that you're simply not sure of another expensive way to invest 3 years.

The smart Trick of Which Positions Make The Most Money In Finance That Nobody is Discussing

It doesn't guarantee you an interview, but it sure helps. A lot of leading schools choose experience, so to make the most of the energy of your MBA it might be a good idea to get a couple more years of work experience and then try applying once again. It's particularly helpful for somebody wanting to enter equities, business technique, or someone who desires to switch fields within financing.

Master's in Finance While a bachelor's degree in financing is typically thought about the minimum requirement for work in the field, numerous positions, consisting of middle and upper management roles, typically need a master's degree for consideration. Opportunities for pursuing an online master's degree in financing abound, and can be discovered at much of the leading financing schools in the country - how much money does a finance guy at car delearship make.